Starting with KYC on blockchain, Tradle is building a global trust provisioning network to give retail, wealth, SME and institutional customers of financial institutions faster access to capital and risk allocation.

Lower the cost of KYC and dramatically speed up the customer journey

Tradle is the only KYC proven to work in all sectors of banking and insurance

We design with regulators KYC portability regionally and globally

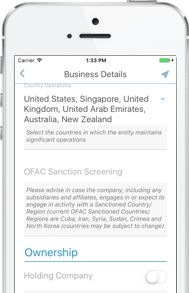

Tradle's blockchain based bot framework enables you to build new customer interactions and customize compliance rules. We take care of all the server, network, security and app pain so you can concentrate on your rapid business evolution.

Learn more

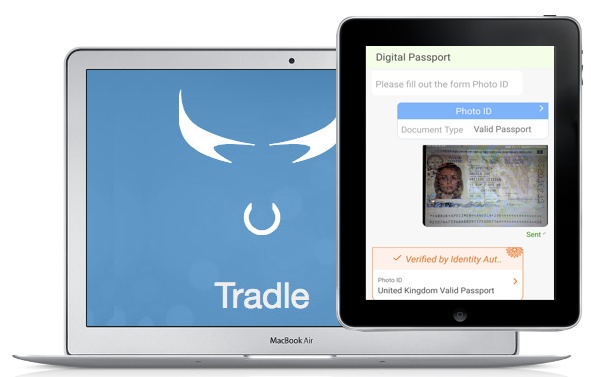

Mobile and web interfaces for customers and employees

Our identity platform was built for a global purpose

Our platform is open source enabling security audit, high speed of innovation, an advantage in government procurement.

We offer pre-integrated vendor products such as biometrics, ID scanning, sanctions and PEPs checkers to provide choice and ease of deployment for institutions.

We can make your custom KYC policy digital, automating data collection, due diligence, KYC sharing and supervision, for any financial product, on the web and mobile. No other vendor can do it; period.